PLAYING THE LONG GAME

Annual reports are changing, but there is still room for improvement in long term strategy narrative and stakeholder engagement. Brittany Golob reports

Experts advise starting your pension fund in your 20s. Family planners suggest trying for a baby for about six months. Students planning on attending university start thinking about their educations in their early teens. Long term planning is a hallmark of modern human life – in terms of education, career progression and family development. Yet, when it comes to a company’s annual report, those long term plans are effectively invisible.

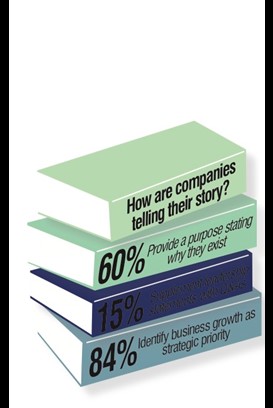

The annual report tells the company’s story. It explains the CEO’s outlook and documents the fiscal success of the business. It talks about culture and brand and it sets the sustainability objectives. It offers to investors a prospectus on why or why not they should consider that company. However, the short termism that plagues annual reports is not improving. The recent Black Sun Complete 100, annual research that examines each of the FTSE 100’s annual reports in detail, highlights this and other trends in corporate reporting.

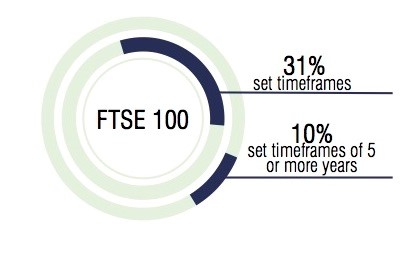

“The long term strategy thing is a tricky one and I think we’re going to see evolutionary change because there are still a lot of unknown factors. With the markets the way they are, companies are afraid of saying something they may not be able to deliver on,” says Black Sun’s lead corporate reporting consultant Anne Kirkeby. “Only 10% set targets for five or more years in the future.”

That’s not to say businesses aren’t planning that far ahead, but they certainly aren’t sharing those plans with investors. Kirkeby says this is a missed opportunity. “Investors want to know as much as possible,” she adds. “But they’re not getting enough information. You have an enormous opportunity in terms of the annual report because you own that narrative and you can tell the story you want to tell and shape the narrative in the way you want to shape it to build trust with your investors and stakeholders.” If companies were to actually do this, they could avoid some of the other challenges facing businesses today. The Black Sun report highlights the lack of trust in business and the ways in which intangible assets support the bottom line as two of them. Setting out a long term strategy would address these questions and provide investors with a more complete picture of the business and its future prospective.

The research also highlights value creation and stakeholder expectations as two major trends in corporate reporting.

“The wider value creation story is a company’s ability to demonstrate the value created for and perceived by stakeholders through how it employs its resources and relationships to take advantage of market drivers and provide a clear sense of what sets it apart to do so,” the report states. In past years, business model reportage largely focused on the description of the business and its strategy. In 2013, only 25% of FTSE 100 companies used value creation as its method for business model reporting. That is now up to 63% of companies.

Kirkeby says that’s a response to large scale shifts in business. “Today, intangible value makes up more of a company’s value than the tangible assets. We need to talk more widely about the value creation strategy rather than what’s in the balance sheet,” she says. This will help the company make more sense to the investor and, she adds, one of the key strategies for doing so is to explain the business’ long term strategy. By reporting on culture, brand and employees as assets, the report can build a stronger picture of a company’s viability.

It seems there’s still a disconnect: companies recognise the need to change their business model reporting, but they aren’t quite doing enough to provide the right kind of information to investors.

Kirkeby adds that this relationship can also influence the company. The market review, she says, should be given more consideration. In an ideal report, the market review would act as the link between strategy and stakeholder. It would discuss stakeholder perceptions and then segue into the external review of the business, which would offer a natural progression into strategy. Currently, stakeholders are only addressed as a group influenced by the company, not one which can exert influence over the company as well. Yet, the biggest stakeholder group companies engage with is its employee base – which 64% say they address. “Companies tend to look at stakeholders as something they impact, but stakeholders increasingly are impacting them as well, and that’s a risk that you need to address,” Kirkeby says.

The annual report, however, does not occur in isolation. It should address internal and external stakeholders’ interest, encourage engagement and set out the strategy and long term value creation plans for the business. But it also needs to respond to the trends that affect global business. A growing trust deficit is one of those phenomena. Reports are also subject to increasing regulation by the UK and the EU – which may change during the Brexit process – and to increasing scrutiny into companies’ sustainability strategies.

In terms of sustainability reporting, Kirkeby has noticed that while many companies still have separate sustainability reports, annual reports are increasingly integrating sustainability infomation. Additionally, the trend toward integrated reporting is growing – despite the fact that most companies who are using that model or report are still not explicitly calling it an integrated report.

“In the Netherlands, for instance, the day they decide they want to do an integrated report, they do an integrated report. In the UK, they’re more hesitant to call it that until its excellent – it may be five or six years – but it effectively is an integrated report,” she says. The overt seven or so companies that produce an integrated report is probably a low estimate among FTSE-listed brands.

But it all comes down to telling a coherent story and addressing all areas of the business as part of the long term value creation strategy. “You can’t really create value without having a good relationship with your regulators, understanding what your customers really want, understanding how you impact the environment in which you operate and the value that you create for those stakeholders,” Kirkeby says. It’s a tall order, but things are changing. This year, companies report more effectively on inputs to their business models, outputs and outcomes. What remains to be done is to link those aspects together within a long term approach.