STRONG YEAR FOR M&A IN PR SECTOR

Prophetic warnings of global turbulence amid an era of economic, political and social instability abound at the beginning of 2017. Following a year which brought Brexit, Trump and what is widely regarded as a ‘post-truth’ era, the implications on business in both the UK and abroad were cited as potentially catastrophic. However, for the PR industry, the first few months of 2017 instead brought a flurry of mergers and acquisitions (M&A). North America in particular has seen strong market resilience among PR firms pursuing the purchase of, or joining between, companies.

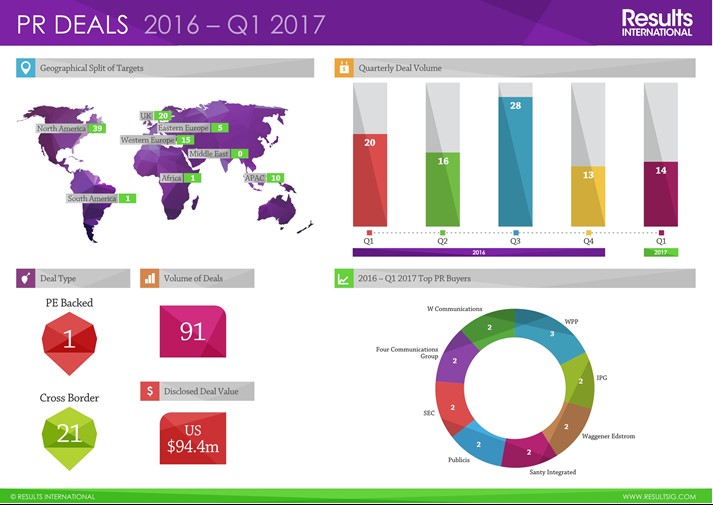

In a study produced and published by London-based M&A and research firm Results International, the first quarter of 2017 saw 14 M&A deals finalised between companies belonging to the PR sector. Up on the results of the last quarter of 2016, which saw 13 mergers and acquisitions completed, all indications point to a trend which will continue to grow through the remaining months of 2017.

Of these 14 completed mergers and acquisitions, the North American PR sector enjoyed the majority of transactions. The region completed 43% of the total M&A deals across the first quarter globally, suggesting that despite market uncertainty, the PR sector is enjoying a period of stability reflected in increased fiscal flexibility. Significantly, Florida-based digital content firm Dolphin Digital Media acquired entertainment industry PR firm 42West for a reported $28m. Furthermore, Interpublic’s the Red Republic merged with Pineapple PR, leading to the latter changing its name to The Pineapple Republic.

The M&A picture was less clear across the pond, however. The UK’s previous 22% share of global PR M&As, last measured in 2016, fell to a mere 14% in Results International’s latest research. In contrast, the study highlighted western Europe’s larger share, up to 21% from 10% in the same period the previous year. However, buyers in the PR space in the Asia-Pacific region have matched this, also achieving 21% of PR mergers and acquisitions globally.

Large PR agencies with multiple offices and strong turnovers were found to lead the way in the 2017 M&A first quarter statistics. Behemoths such as UK-based advertising and public relations firm and one of the ‘Big Four’ agencies, WPP, completed three purchases. Other multiple acquirers including IPG, W Communications and Waggener Edstrom.

Keith Hunt, managing partner at Results International, says, “It’s not just the trade buyers and major marcoms groups that are looking to invest in PR. Management consultancies are keen to reinforce their links with the C-suite and PR is still seen as one of the best ways to get in front of the world’s most senior leaders.”

“The traditional PR buyers themselves are looking for agencies with scale, size and client commitment, but also for those with a more integrated offering, hence the increasing interest in content and social media businesses,” continues Hunt. “Yet there’s no doubt that appetite remains for investment in PR businesses both niche and generalist. We wouldn’t be surprised to see some major deals in this space over the coming months.”

The report by Results International also points to evidence that the historic gap between the marketing and communications sector, and the public relations sector, is narrowing. Given the strong start to 2017 enjoyed by both sector, any further developments will be monitored by agencies and companies alike.